WIZKID NEWSLETTER (18 Feb - 4 March)

In here you will find all the necessary information to stay-up-to date with crypto's hottest trends, news and insights.

Everything you need to know compressed into a 5-10 minute read.

Newsletter topics:

- Crypto's hottest and most relevant news

- Technical analysis of the crypto market

- What BTC whales are doing + on-chain analysis

- DeFi update

- NFT update - Calculated NFT Investing

MAJOR CRYPTO NEWS

The city's regulators are looking to finally provide some clarity. Will it be enough to retain crypto companies leery of China's growing sway? February 18th

Security research firm PeckShield points to on-chain data that shows 516 ether is on the move. February 18th

Ethereum gas fees are finally in decline. The simmering of the red-hot Ethereum NFT market is the best reason why. February 18th

United States banking giant JPMorgan Chase has unveiled research on a quantum key distribution (QKD) blockchain network that is resistant to quantum computing attacks. QKD utilizes quantum mechanics and cryptography to enable two parties to exchange secure data and detect and defend against third parties attempting to eavesdrop on the exchange. The technology is seen as a viable defense against potential blockchain hacks that could be conducted by quantum computers in the future. February 18th

Only two times before has the proportion of available supply been so overwhelmingly stationary in its wallet. February 21st

Ontario Securities Commission sent the tweets from Coinbase CEO Brian Armstrong and Kraken CEO Jesse Powell to the Canadian police. February 22nd

The increase in tension on Monday sent U.S. stock index futures to session lows and BTC back towards the bottom of its recent price range. February 22nd

Intel’s new chips are powered by a high-performance miner to deliver up to 40 TH/s in a balanced environment. February 22nd

The situation shows the limitations of a government’s ability to thwart transactions on decentralized systems – but also the limitations of those systems to circumvent such sanctions. February 23rd

The largest Latin American country could soon be the latest to regulate crypto, which lawmakers hope will increase its uses across the country. February 23rd

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MKIDQSQNB5PAVAX6WACP3EZUAE.jpg)

The Thursday announcement stems from a late-2020 enforcement action. February 25th

Brokers will not be able to execute trades on Russian equities for non-residents as central bank prepares for tumultuous market opening. February 25th

The Unchain fund has raised $1.8 million and plans to launch a DAO this week, even as team members live with sirens, explosions and artillery barrage following the Russian invasion. March 2nd

NFT artist Pplpleasr is bringing long-form animation to Web 3 through a new venture, Shibuya, which went live with its beta version on Tuesday. Shibuya will crowdfund production of long-form visual content – such as short films, movies or television series – by selling non-fungible tokens (NFT) called “producer passes,” disrupting the traditional studio-driven methods that now dominate the industry. Unveiled at the Ethereum Conference in Denver on Feb. 18, Shibuya is the latest brainchild of Pplpleasr, an NFT artist who first gained mainstream attention after her Fortune magazine NFT cover raised $1.3 million. Now, she’s pushing the boundaries of NFT use cases. March 2nd

Federal Reserve Chairman Jerome Powell is back on Capitol Hill to deliver his semiannual monetary policy update, this time testifying before the Senate Banking Committee. Powell indicates that the central bank still backs a quarter-point interest rate hike in March against a backdrop of surging inflation in the U.S. and balancing the unpredictability of the Russia-Ukraine war. March 3rd

At issue is whether certain tokens should be considered securities and thus regulated. March 3rd

The FCA has 50 live investigations into crypto-related businesses that have not registered with the authority. March 3rd

France’s Finance Minister, Bruno le Maire, said the European Union is making sure cryptocurrencies don't let Russia evade sanctions. March 3rd

TECHNICAL ANALYSIS

BTC Support/Resistance -

Support = A support level represents a price point that an asset struggles to fall below over a given time period.

Resistance = A resistance level represents a price point that an asset struggles to exceed over a given time period.

The $44,000 - $45,500 range (horizontal box) has been a pivotal area for BTC since Feb’21. In December ’21 (green box) this region acted as significant support, and once price fell below it in January, it became a key resistance level (red box). Currently BTC is below it and failing to break above.

Just above the region, purple line at $46,200, is the yearly open price. Meaning the price BTC was at on the 1st of January, and happens to be just above the previously discussed range. Once this is broken and we close a 1D candle above it I will flip bullish. As long as BTC remains below this level I am trading with additional caution.

BTC 20 & 50 EMAs -

Here is an update on the exponential moving averages chart from the first newsletter, published on the 20th of Jan (technical definitions available there). The crossing of the 20 and 50 day EMAs is a very good macro momentum indicator. We are seeing bearish momentum on BTC as the 50EMA (red line) is still above the 20EMA (green line). The 20EMA is heading upwards currently, and should BTC hold above $40k for another week, the 20 will cross the 50 which will flip this indicator bullish. This will be a strong sign for me to begin re-entering BTC and the crypto market at large.

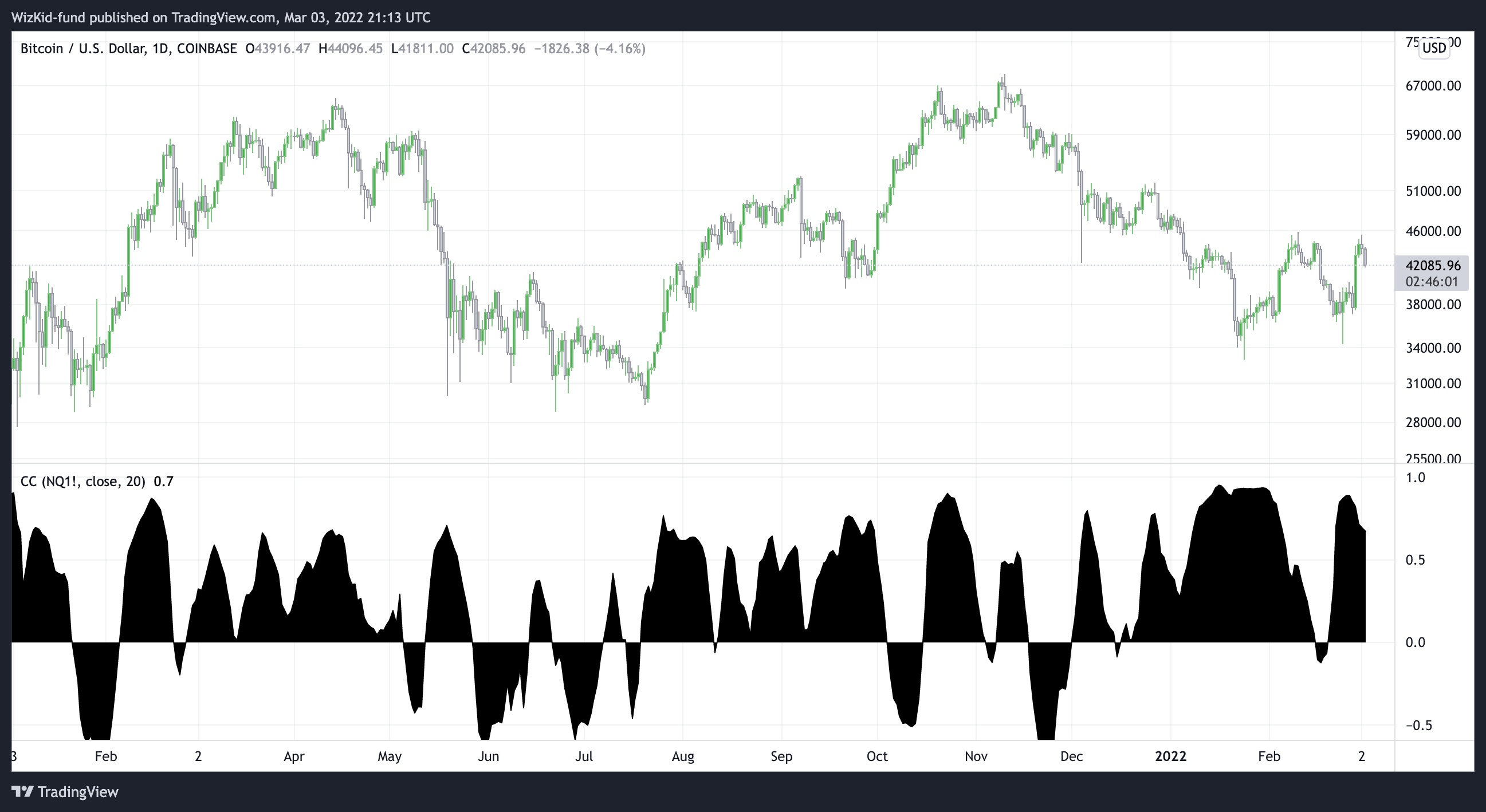

Correlation

Another note on BTC is that its correlation with the traditional markets, as discussed in the second newsletter, is on the decline, after being at historical highs in Jan and early Feb. The chart below shows the correlation coefficient between BTC and the NASDAQ.

Correlation Coefficient (CC) - Is used in statistics to measure the correlation between two sets of data. The closer the Correlation Coefficient scale is to 1, the higher the assets’ positive correlation. Meaning they move up and down together.

The fact that we are decoupling (loosing positive correlation) is a good thing in some ways, as BTC will be less tied to the stock market’s movements, though I think this loss of correlation is unlikely to last should high volatility in the traditional markets resume.

We can only speculate on how the geopolitical climate will unravel in 2022, but sanctions on Russian gas are already skyrocketing the price of oil, which will have a severe impact on energy prices and cost of production in Europe and the rest of the West. This will likely lead to higher inflation.

Oil Chart - Heading upwards rapidly since May 2020. Rejected from a significant historical resistance level of $115 per barrel.

The last chart I will leave you with is that of the Moscow exchange and the Russian Ruble currency.

MOEX is the Moscow Exchange, an index that tracks the performance of the 50 largest stocks across 10 sectors in Russia.

As we can see, the Russian economy has just been devastated. Their currency is 30% weaker in 2 months, and their stock market valuations are down 50% in 6 months. It looks like Russia will become economically crippled for the long term if they stay in Ukraine much longer. Just in the month of February, the average Russian lost +30% of their spending power outside of Russia because of their leader's actions.

ON-CHAIN ANALYSIS

It is important to note that on-chain metrics can be, and have been, manipulated by whales. Nevertheless, here at Wizkid Fund we pick out the statistics that are less likely to be affected by these big players and give a broader understanding of where the market could be heading.

Global markets have faced a very sobering week, as armed conflict breaks out between Russia and Ukraine. As a global macro asset, and with markets that never close, the price of Bitcoin was quite volatile in response. This week the market traded down to a low of $34,474, before rapidly recovering to a high of $39,917.

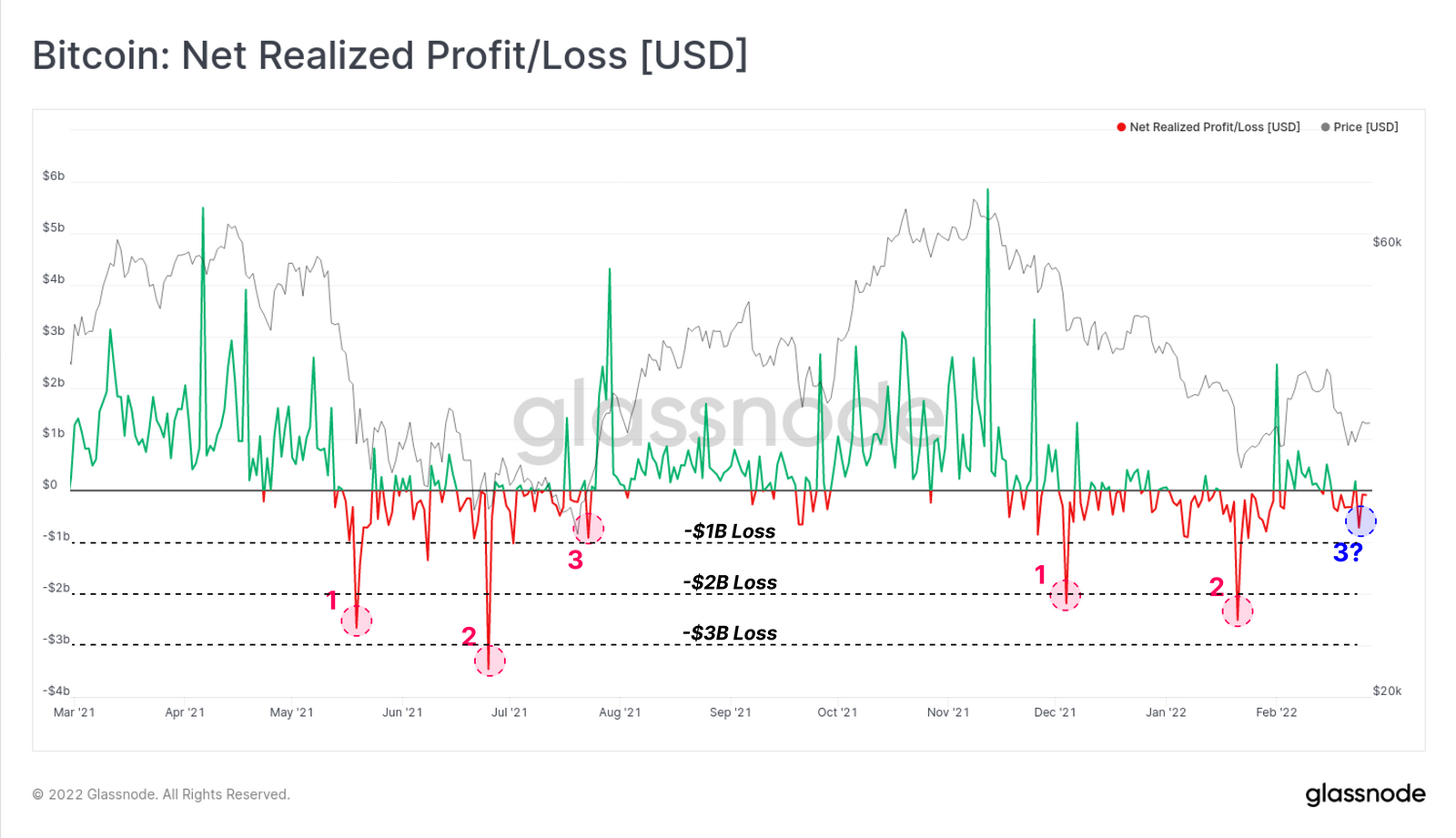

Metric 1 - Bitcoin: Net Realized Profit/Loss (USD)

If there would be a time that Bitcoin investors would capitulate, especially those who see it as a risk-on asset, that time would be now with the devastating news of war between Ukraine, Russia, and, now potentially, Europe.

However, the degree of on-chain capitulation that occurred during this weeks sell-off was tame to say the least. In fact, there are a lot of similarities to the 20-July-2021 sell-off to $29k (point 3 above) which simply didn’t have enough bearish sell pressure to break new lows.

This week we saw net realised losses of $713M which is significantly less than the $2.0B+ capitulation events experienced earlier in the correction.

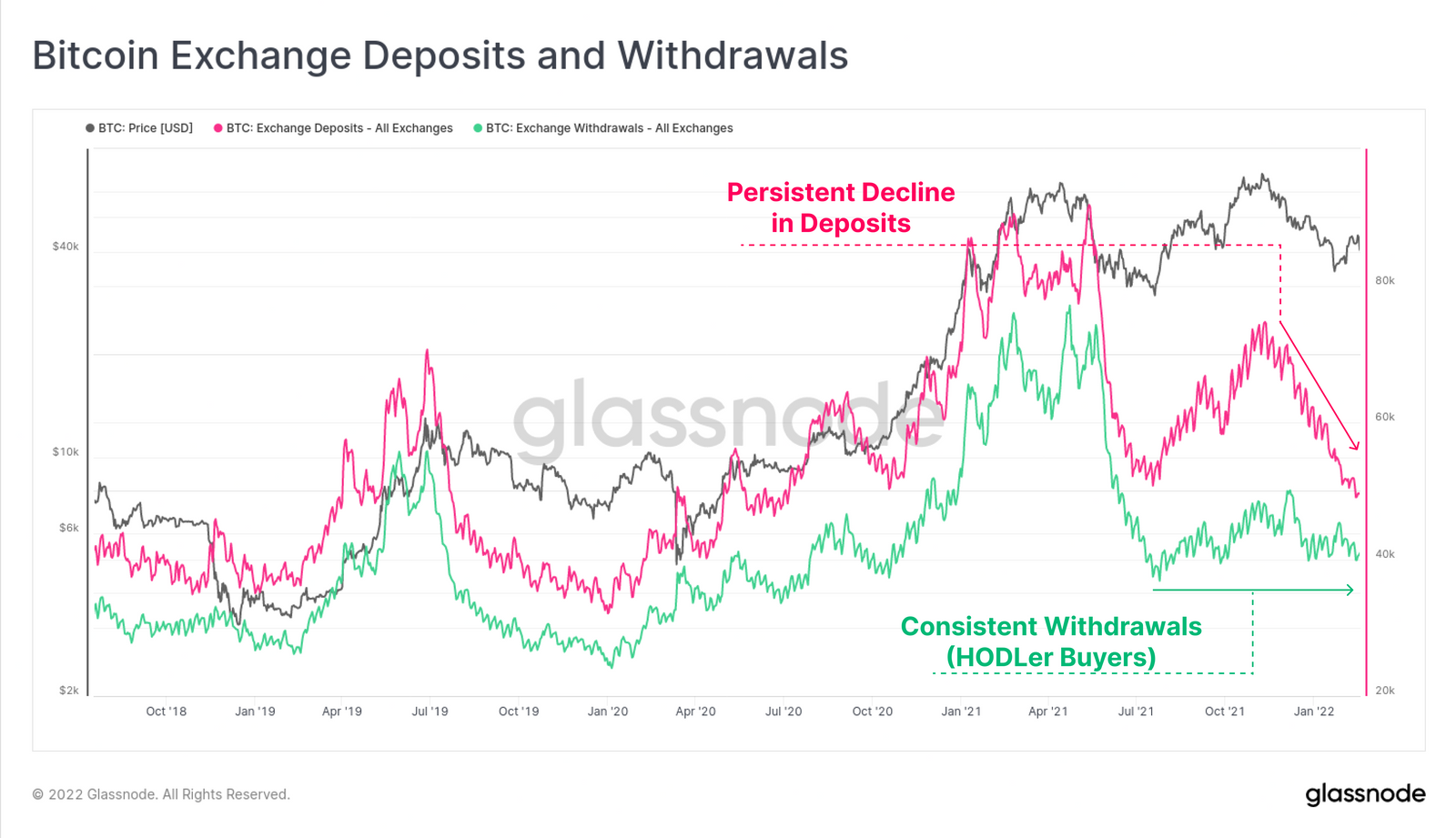

Metric 2 - Bitcoin Exchange Deposits and Withdrawals.

Over the last 3/4 months we have seen a persistent decline in the number of Bitcoin deposited to exchanges (pink) falling from 74k/day at the November ATH, down to 41k/day today. Meanwhile, exchange withdrawals are holding very steady at around 40k to 48k/day.

This is once again indicative to a growing pool of HODLers who are withdrawing Bitcoin and holding it for the long-term.

DeFi Update

The DeFi sector overall has lost a lot of value in the past months, and many charts look due a relief rally. I.e. DeFi may be short term bullish.

$ATOM ecosystem in particular is booming. Here is a list of tokens from the $ATOM/COSMOS ecosystem. In the last two weeks some of the top performers in DeFi have been in ATOM’s IBC ecosystem. LUNA, MIR, ANC, OSMO & JUNO.

A new $ATOM ecosystem token is launching this week, Evmos, and it will be airdropped to all users who have been rug-pulled (scammed) or spend a significant amount of gas on the Ethereum network. The Evmos token will be the ecosystem token of their own IBC, Inter Blockchain, for which they are launching a cross-chain DEX (decentralised exchange).

Hot DeFi Projects -

QUARTZ / Sandclock - innovative, institutional & normie friendly DeFi. Sandclock is a cross-chain yield optimizer that’s simple enough for your mother to use, yet insured and licensed to the point of being useful to institutions. It has fiat on-ramps and is fully insured.

Their main-net is launching this month and their token price is currently beaten down heavily, at a tiny market cap of $20million.

They also have no VCs and big upcoming price catalysts such as exchange listings, product launches and partnerships. The $QUARTZ token will provide boosted yield to stakers, similar to $CRV. Here is a valuation model for the token: https://docs.google.com

They have a young experienced team and some influential backers. Backers include Raoul Pal and Kevin O’Leary, who have both spoken on panels with the $QUARTZ team.

Here is a video from the founder explaining the project; https://youtu.be/K0fXippL2ZQ

NFTs - Calculated NFT Investing

In last weeks newsletter we discussed “How do we distinguish the good from the bad NFT projects?” by looking at the team, socials and mint prices.

Today we will look at calculated NFT investing. We are going to give you the data, metrics & numbers you should be looking at before investing into an NFT project.

Numbers don’t lie.

We will use the OpenSea NFT Marketplace as reference today.

1. Holders:

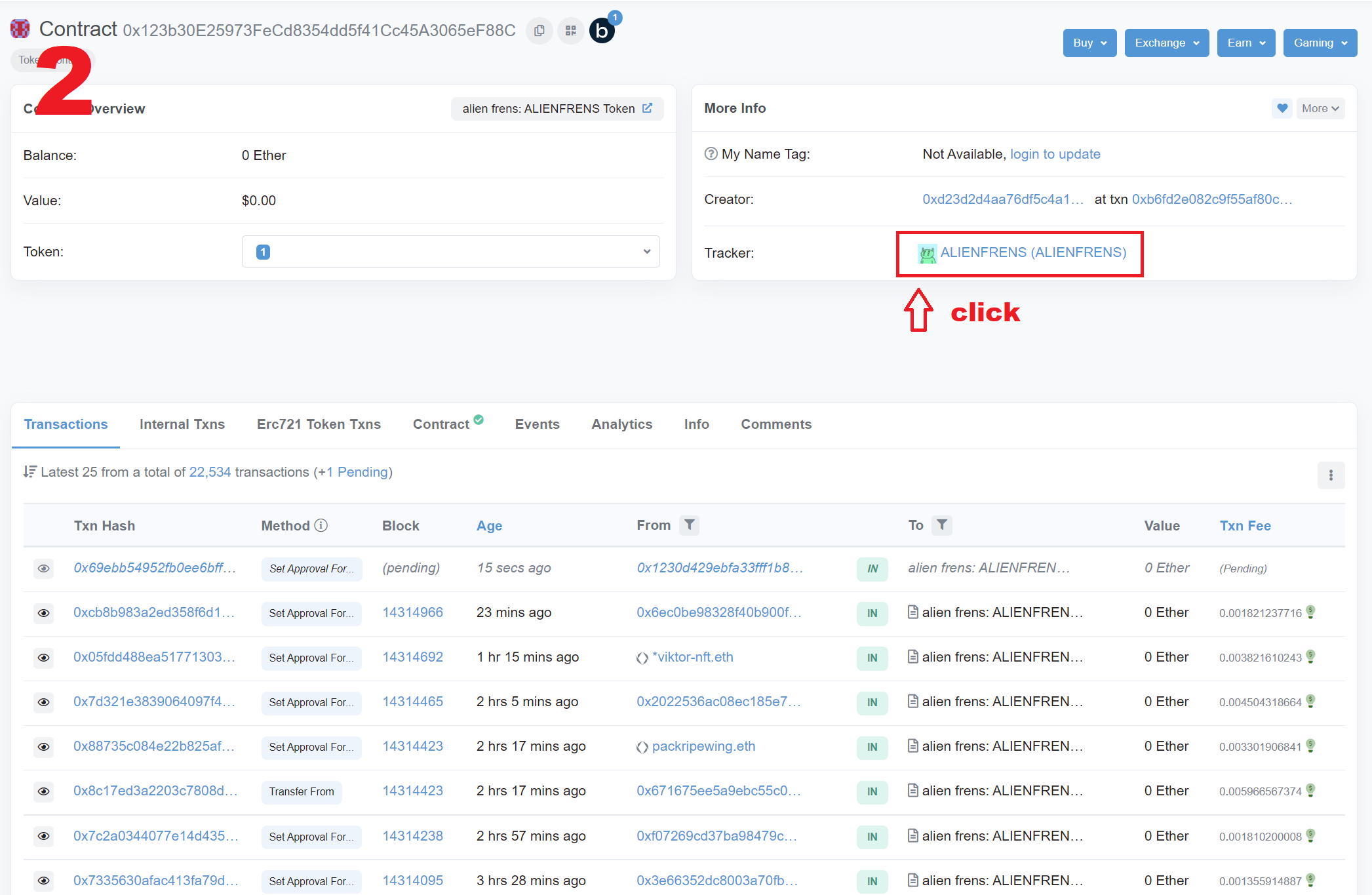

The first thing you will want to do is analyse who the top holders are of this collection. You can do this by doing the following:

1. Find your NFT project on Open Sea

2. Click on any item in the collection

3. Click Details (picture 1)

4. Click Contract Address (picture 1)

5. Click on the NFT Project name (picture 2)

6. Click on the Holders Tab (picture 3)

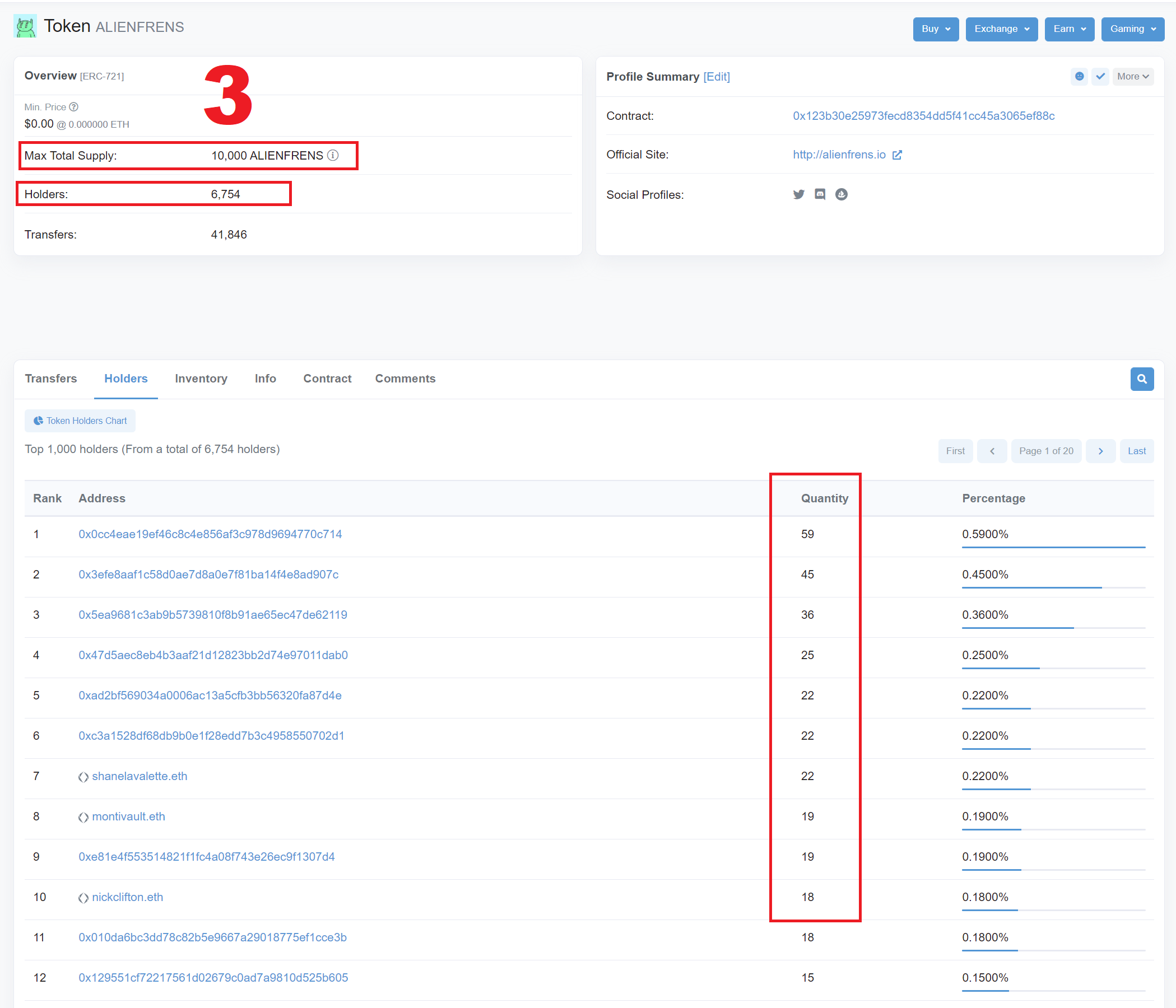

You want to find out what kind of people the top 10-20 Holders are.

- How many are they holding and at what price did they buy in?

- Are they people that regularly sell and move on?

- Are they known collectors?

- Do they have a history of being long-term holders with other projects?

This will give you an idea of how much “sell pressure” you could expect at different stages of the project’s lifespan. Typically, if you see a large wallet holding more than 3-5% of the total supply, this is a VERY big red flag. Unless it’s a single wallet owned by the founders as they generally allocate 5-10% of supply for giveaways itself.

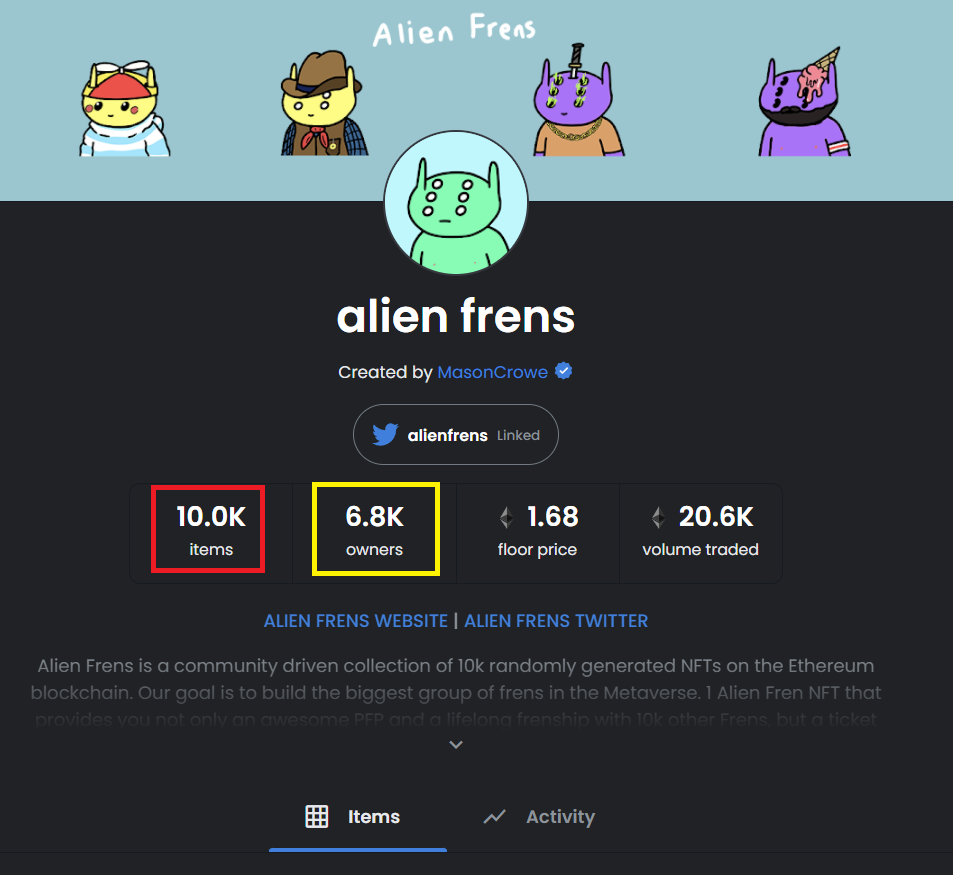

2. Distribution:

10,000 items

6,800 owners

Distribution = 68%

This tells me how many unique holders (people that just hold 1 item) there are. The theory in general goes; the less people that own multiple items results in less sellers and ultimately less sell pressure.

The larger the distribution % the easier it becomes for price movement to move upwards. In essence you want to look for projects that have at least 50% of their supply distributed to unique holders.

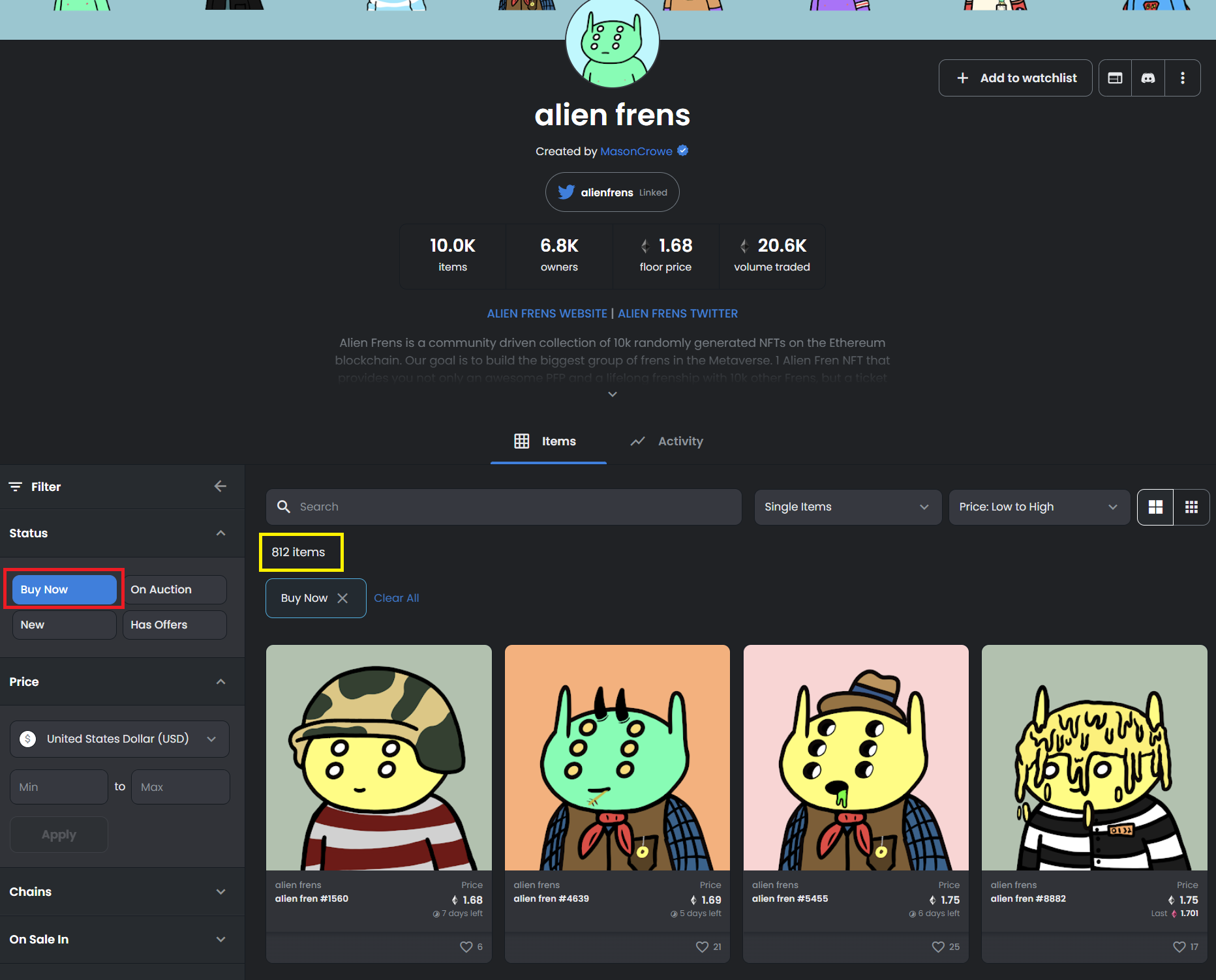

3. Listed items:

Another thing you want to be doing is checking how many items are actively listed with the “Buy Now” function. This will give you an indication of how many items are up for sale in that moment from the entire collection.

The lower the number of listings, the less sellers. This is normally an indication

that people believe in the project and prefer to be holding rather than selling. In general, the rule of thumb remains, as the total number of items listed for sale decreases, the easier it becomes for price to move upwards.

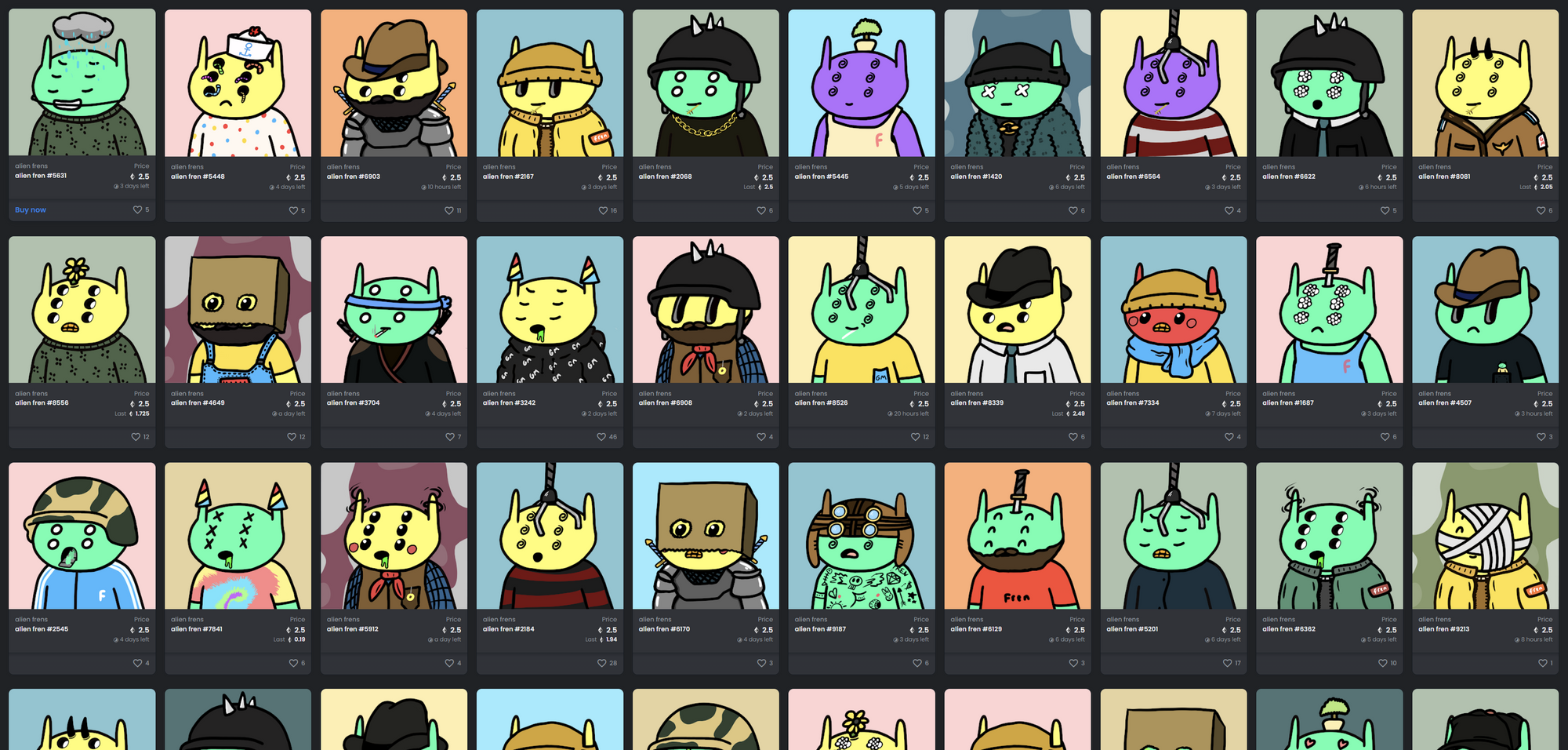

4. Price Walls:

Above you see an image representing 30 Alien frens listed at 2.5 Ethereum. This is something we refer to as a “Price Wall” in the NFT space. It illustrates an area where many NFTs are listed at the same price, these are typically psychological levels such as 1,2,5,10,15,20 and will depend on the general price of the collection.

This will give you an idea of where you might encounter resistance during upwards price movement. If you are looking at trading a collection you will want to be selling before this area of resistance gets hit.

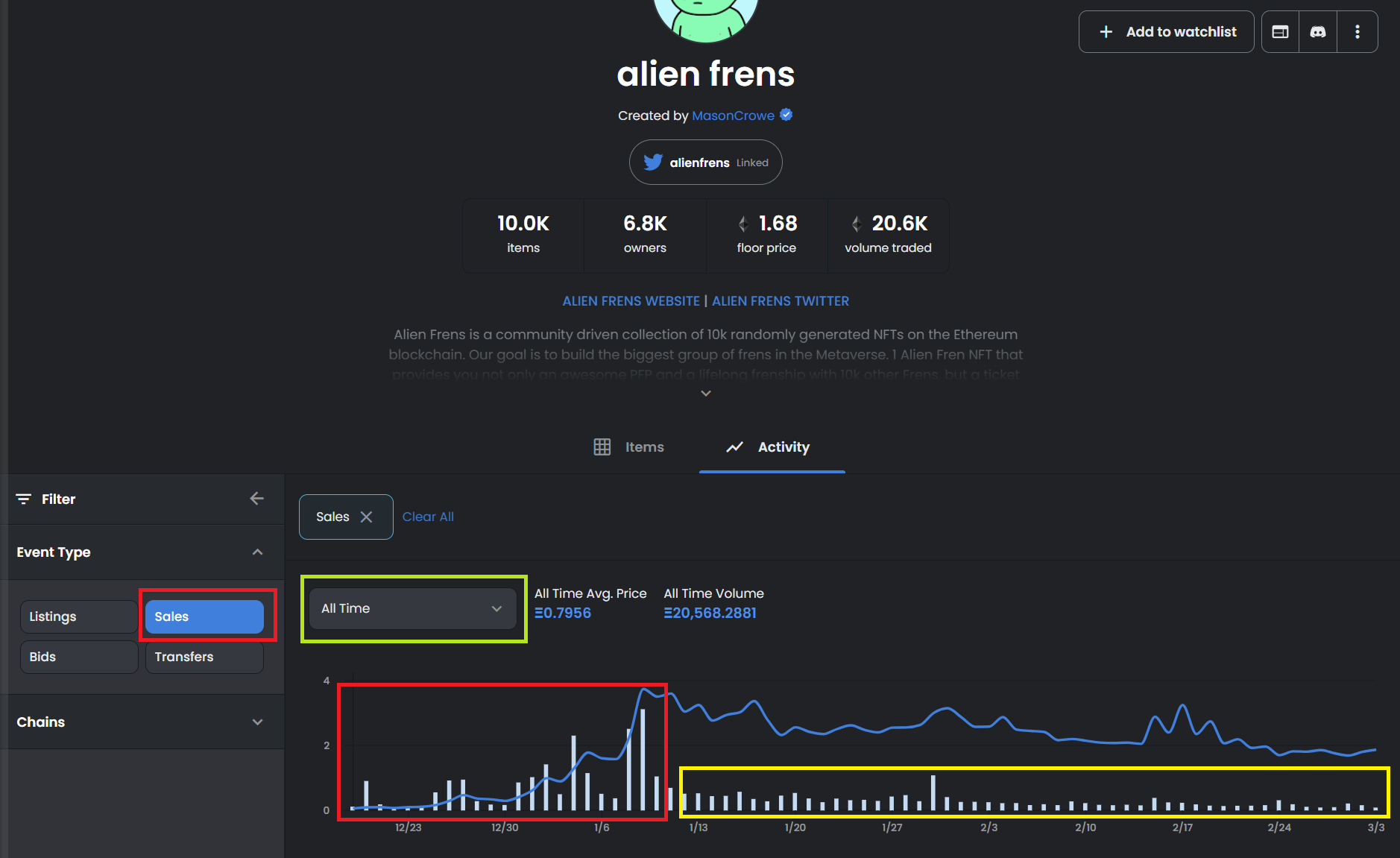

5. Volume, sales and price chart:

When you click on the “Sales” button highlighted in red above, you will be represented with a chart illustrating the volume (turquoise bar charts) and the floor price (light blue line) over a specified period.

As you can see there was A LOT of volume within the first month of this collection launching (red box), this is typically due to large amounts of hype building around a project when it launches, as well as a lot of marketing taking place from the team itself.

Typically, you do not want to be buying when there is so much hype and volume. You want to wait until the project cools off (yellow box) and finds support on a certain floor price. This will also give you time to find out whether the team continuous building, the community is happy and strong and whether you still want to invest into the project whilst its more quiet.

It is important to note that these are pure number based indicators and by itself this is not sufficient to analyse a project. Please refer to last weeks newsletter NFT section to obtain additional insights on how to review a project.

A word from WizKid -

Thank you for reading and don't forget to subscribe to be notified for the next release.

- WizKid Team

Telegram daily market updates channel: https://t.me/WizKidSentiments

Telegram Ibiza Crypto Community group: https://t.me/IbizaCryptoCommunity

The information provided herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content recommended is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome