WIZKID NEWSLETTER (6-20th January)

This is the first edition of our Bi-Weekly Newsletter. In here you will find all the necessary information to stay-up-to date with crypto's hottest trends, news and insights.

Everything you need to know compressed into a 5-10 minute read.

Newsletter topics:

- Cryptos hottest and most relevant news

- A professional technical analysis of the crypto market

- what BTC whales are doing and on-chain analysis

- DeFi

- NFTs

MAJOR CRYPTO NEWS

Walmart enters the crypto world in full force - Walmart prepares to launch NFTs, a cryptocurrency, and get involved in the metaverse.

They recently filed 7 US Patents examining the potential monetization of NFTs and the metaverse.

Swiss banks test digital currency payments with top investment banks - Switzerland tests digital currency payments with top investment banks, including Citibank, Credit Suisse, UBS, and Goldman Sachs.

In addition 68% of private Swiss banks are interested in offering Bitcoin services within the next 3 years.

Rio De Janeiro to Invest 1% of Its Treasury in Cryptocurrency - The mayor of Rio de Janeiro, Eduardo Paes, said that the city will allocate 1% of its treasury fund for the purchase of Bitcoin.

Rio will become the first city in Brazil to purchase and adopt Bitcoin as a store of value. The Mayor of Rio wants to follow in the footsteps of mayor Suarez in Miami, who is working to turn Miami into a major cryptocurrency hub.

In addition, Rio wants to offer a 10% income tax discount for those who pay in Bitcoin.

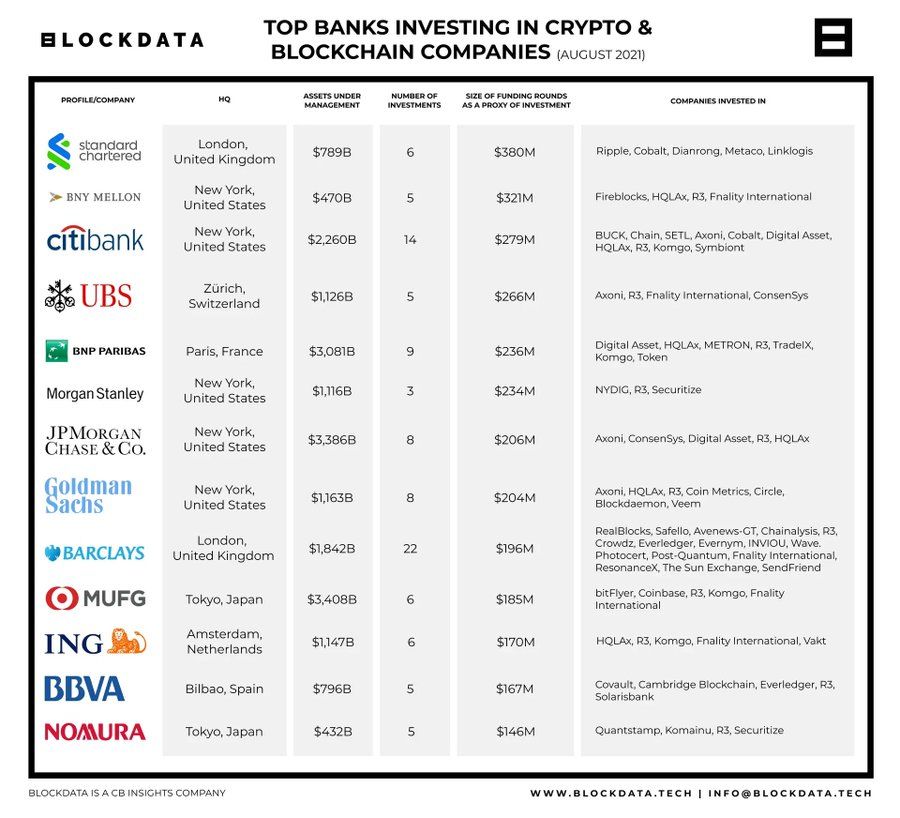

55 of the 100 world's biggest banks have invested in crypto/blockchain companies - According to research by Blockdata, a blockchain market intelligence outfit, 55 out of the top 100 banks by assets under management (AUM) have some form of exposure to the novel technology sector.

PayPal Explores Launch of Own Stablecoin in Crypto Push -

“We are exploring a stablecoin; if and when we seek to move forward, we will of course, work closely with relevant regulators,” - Jose Fernandez da Ponte; senior vice president of crypto and digital currencies at PayPal.

Coinbase and Mastercard partner to revolutionize NFT purchase experience - The largest U.S. cryptocurrency exchange announced the partnership with payment giant Mastercard on Tuesday. The partnership aims to simplify the experience of buying non-fungible tokens (NFTs); digital ownership certificates for goods such as art pieces, that have seen soaring popularity in the past year.

Bitcoin network is stronger than ever as hash rate hits new all-time high after China ban - Hashrate is a term used to describe the computing power of all miners in the Bitcoin network. China had long been the epicenter of this industry, with past estimates indicating that 65% to 75% of the world’s Bitcoin mining happened there. After Beijing effectively banished the country’s cryptocurrency miners in May last year, more than 50% of Bitcoin’s hashrate was lost from the global network.

As of last week, data from Blockchain.com shows that the network has recovered those loses, up over 110% in five months, making a new all time high in hashrate.

German online bank N26, one of the largest European fintech companies, will launch crypto trading later this year - German neobank N26, one of the biggest European fintech companies with a $9-billion valuation, is finally ready to tackle crypto and equities trading after as part of their global expansion plan.

Intel Set to Reveal 'Energy-Efficient' Bitcoin Mining Chip - Tech giant Intel is releasing a new "ultra-low-voltage" Bitcoin mining chip, which they will reveal at an industry conference next month.

This will be their first purpose built BTC mining chip, and shows that they are looking to compete in the mining hardware space, which will stimulate further improvements and could drastically reduce the carbon footprint of BTC mining.

Microsoft to buy Activision in a $68.7 billion deal -

Microsoft announced on Tuesday that it will buy video game giant Activision Blizzard in a $68.7 billion all-cash deal. "Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms," - Microsoft CEO Satya Nadella.

TECHNICAL ANALYSIS

BTC 1

Red line - 50EMA, Green line - 20EMA. Moving averages show you the average price of an asset over a period of time. The 50 day and 20 day moving averages are some of the easiest indicators to use and understand. Here we can see that when the 20EMA crosses below the 50EMA on BTC it is (usually) a good time to sell. The opposite is also true. Currently the 20EMA is below the 50EMA and for risk averse investors a safe and reliable signal to enter BTC could be waiting for the 20 to cross back above the 50.

BTC 2

Upper Chart - Here we are seeing a descending price compression scenario play out which is quite similar to what happened in May - July.

Lower Chart - It took 63 days for BTC to break the May - July range. Here the previous range price pattern has been copied and pasted over the current range. Should last summers scenario repeat itself we can expect a last test of the 35-39k region before heading upwards and breaking out of the range. A major concern around the current price action is lower volume. The volume in the first blue range is over 3x more than our current range volume.

ETH

50EMA & 20EMA. Ethereum is in a mid-term downtrend as evident by the 20EMA being below the 50EMA. We are currently holding a psychological support at $3000. Should we break $3000, $2800 looks like the next support. Technical analysis would say there is not much going for ETH although the on chain data and fundamentals paint a different picture.

DeFi

TOTAL DEFI Market Cap - This chart tracks the market cap of some of the most important DeFi projects. Should we loose the $8,000 level we are likely to see a significant loss of value in the DeFi sector. How this chart plays out is largely dependant on BTC’s price, as there is a strong correlation between other cryptos and BTC’s price.

WHAT ARE BTC WHALES DOING?

Whales = A whale refers to individuals or entities that hold large amounts of bitcoin. Whales hold enough cryptocurrency that they have the potential to manipulate currency valuations.

The Bitcoin market returned to a more docile state following a fear-fuelled drawdown in Week 2. Investors and traders appear to be digesting the macro possibilities alongside an increasingly hawkish Federal Reserve. This change in tune has rattled the Bitcoin market in the short term and has put medium-term scenarios at risk.

The market opened at $41,718, briefly corrected down to $39,821, before reclaiming the psychologically significant $40k level. The remainder of the weeks price action was more predictable, hitting a high of $44,000 for roughly 48 hours.

Unbeknown to most people, every transaction is visible to anyone in the blockchain world, you only have to look for it. Luckily enough, there is artificial intelligence (AI) in place to do this job for us, all we have do is analyse it.

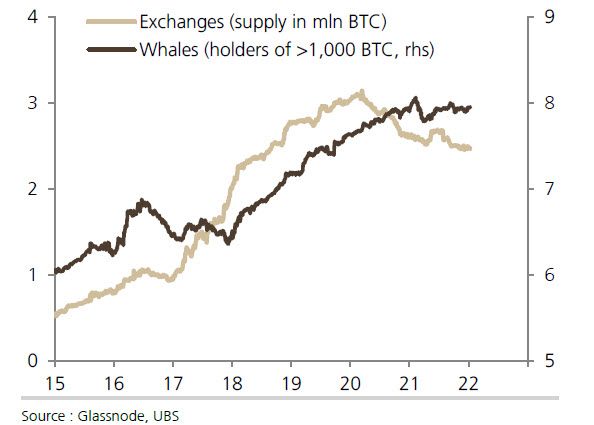

Illustrated above is a chart comparing the total supply of Bitcoin held by Exchanges and the number of Wallets that hold more than 1000 Bitcoin aka. Whales, roughly $42,000,000 dollars. For the first time since mid-2017 Whales are accumulatively holding more Bitcoin than Exchanges. This being said, they are still accumulating, and they are not stopping by the looks of it.

WHAT ELSE CAN WE SEE ON-CHAIN ?

Bitcoin: Percent Supply in Profit is an important and interesting chart to look at.

In simple terms, this chart illustrates how many of the people holding Bitcoin (BTC) are in profit.

As we speak, Bitcoin is -38% down from all-time-high set in November 2021. As the drawdown worsens, an increasingly significant volume of BTC supply has fallen into an unrealized loss. Approximately 5.7 million BTC are now underwater. (~30% of circulating supply).

The Bulls are working hard to defend the historically significant level as illustrated above with the black dotted line. This exact level was defended in two instances over the last few years:

- May 2020 - July 2020, the quiet recovery period following the extreme move downwards from Covid-related panic.

- May 2021 - July 2021, the choppy and accumulative period following a historical deleveraging event.

How the market reacts to this level will provide a lot of insight into the short/medium-term direction of the BTC market. Weakness may incentivize underwater holders to capitulate, whereas a strong bullish impulse backed by volume may provide much needed relief as well as put more coins back into unrealized profit.

The sell-off that we experienced last week saw more than 60% of the volume in a loss, reaching levels that have previously coincided with capitulation events. Over the years, similar events have been followed by a bullish reversal.

Could the reversal be near?

DeFi

DeFi - Decentralized finance (DeFi) is an emerging financial technology which removes the control banks and institutions have on money, financial products, and financial services.

In the DeFi world the $ATOM, $NEAR and $FTM blockchains are accelerating ahead of the pack in development and new users this month. All three blockchains are faster and cheaper than Ethereum and so many investors are exploring them as new funding and liquidity is entering their ecosystems. Due to the compatibility and ease of bridging to Fantom, this blockchain (and the projects emerging on it) is my personal favourite pick for DeFi plays this quarter.

A+ rated DeFi developers Andre Cronje ($YFI founder) and Daniele Sesta ($TIME/$MIM founder) are teaming up to launch a new token, which will undoubtably have innovative DeFi mechanisms built in to integrate with their current suite of cross-chain DeFi applications (frog nation). This hype has brought lots of liquidity onto the Fantom network in January which has been reflected in the $FTM price.

Hot DeFi projects;

ABRACADABRA - Currently offering 0% interest loans on ETH and BTC. Issuing MIM stablecoin (value pegged to $1) which you can then use freely. This is a form of soft leverage and you will get liquidated if you borrow irresponsibly.

TIME / wMEMO - High interest (currently over 60,000% APY) rebasing DAO token. Cross-chain and developing relentlessly, strong community. Price has been beaten down and I’ve taken an entry below $55,000 ($wMEMO).

DEFI KINGDOMS - Constant new announcements and cross-chain compatibility coming soon. Very hyped right now but something to watch for an entry in the event of further downside in the market. The $10 area is quite appealing.

Consult with WizKid for further info.

NFTs

NFTs have taken the world by storm over the last 6 months. With famous artists, big fashion and sports brands joining the momentum and launching their own NFT collections, retail and big investors have swarmed into this new craze. This is especially clear when you look at the analytics of OpenSea (link), the primary online marketplace for NFTs.

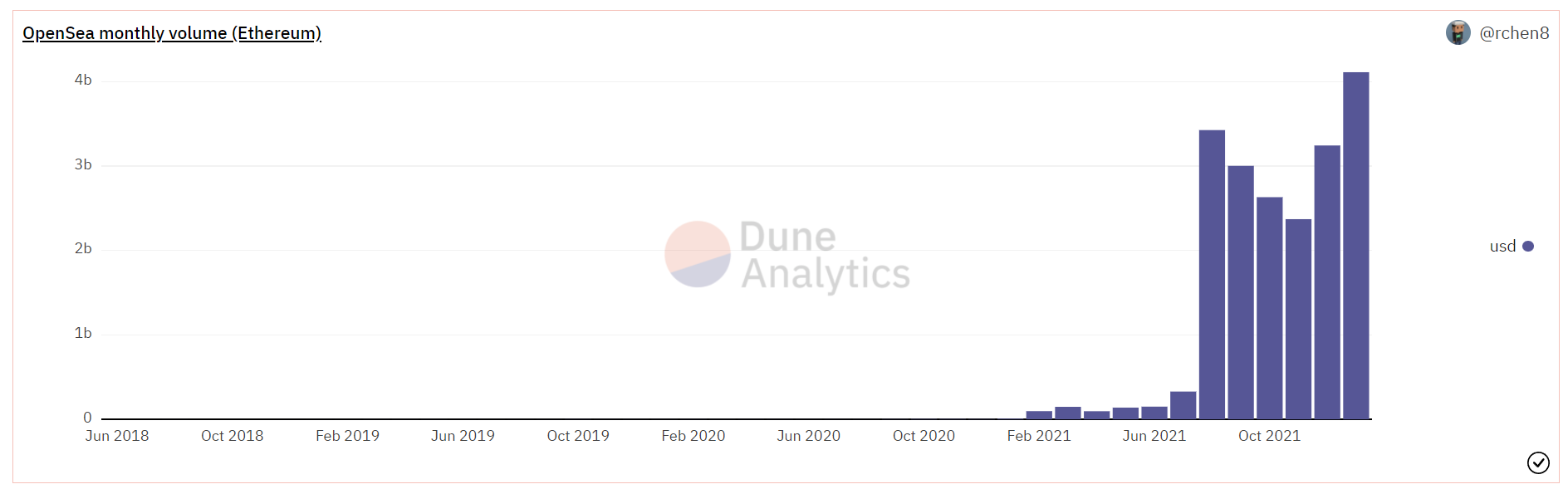

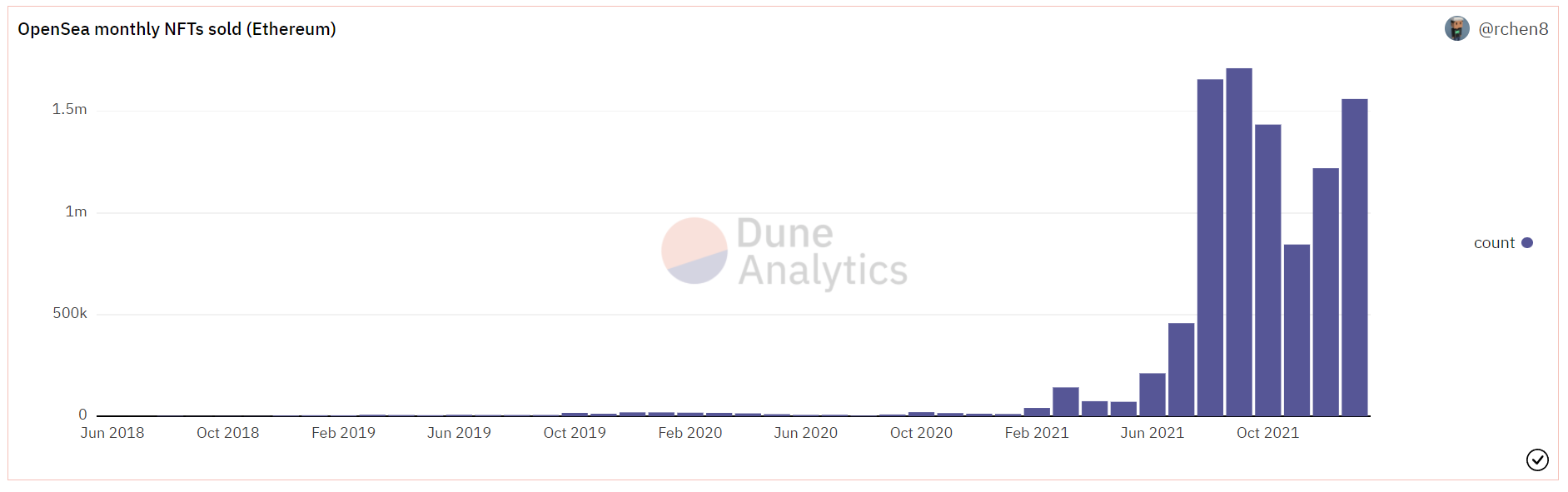

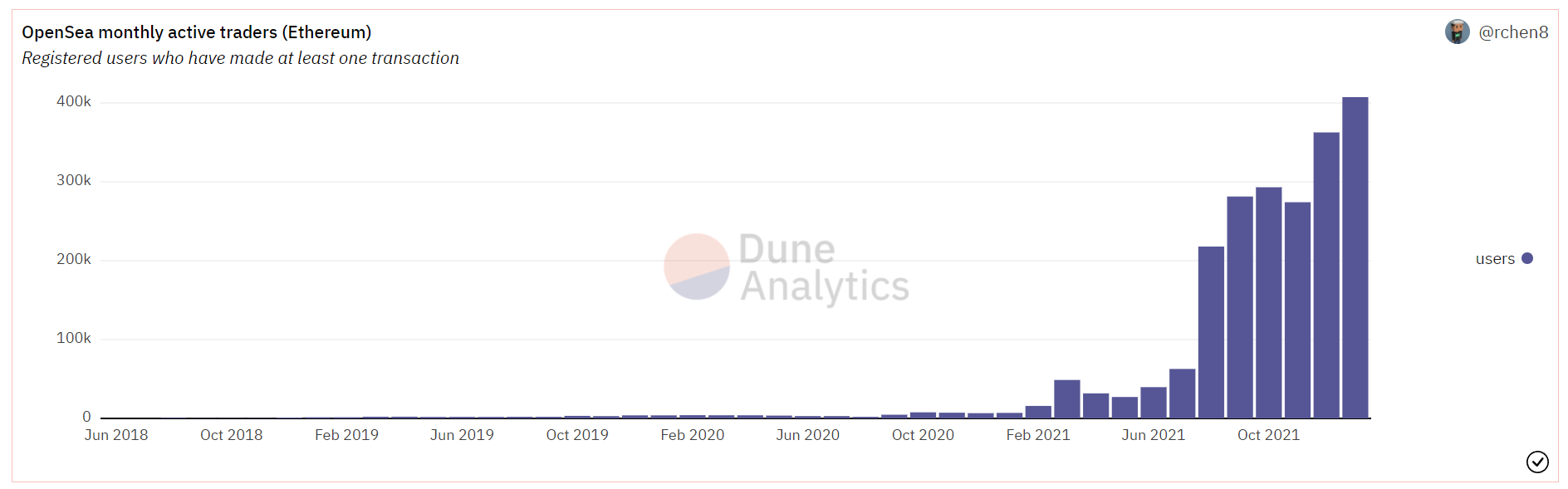

Today we will look at the 3 most important analytics for OpenSea, monthly volume, monthly NFTs sold and monthly active traders.

The monthly volume on OpenSea has risen from 150 million dollars in July 2021, to 4.1 trillion in January 2022. That is a 2700% increase over the course of 6 months.

Monthly NFTs sold has risen from 71,000 to 1,561,000 marking a 2100% increase over the last 6 months.

OpenSea monthly active traders has risen from 40,000 to 407,000. That is an increase of 1000% within 6 months.

With monthly active traders peaking at 407,000 this month it is clear, this is only just the beginning for NFTs. Once these marketplaces start to become more easily accessible to the general public this figure will grow to the millions and eventually billions.

This being said, we are still early to the world of NFTs and have only witnessed a tiny spectrum of what they are truly capable of.

In the next newsletter I will dive further into the vast capabilities of NFTs and how they can be incorporated into our world.

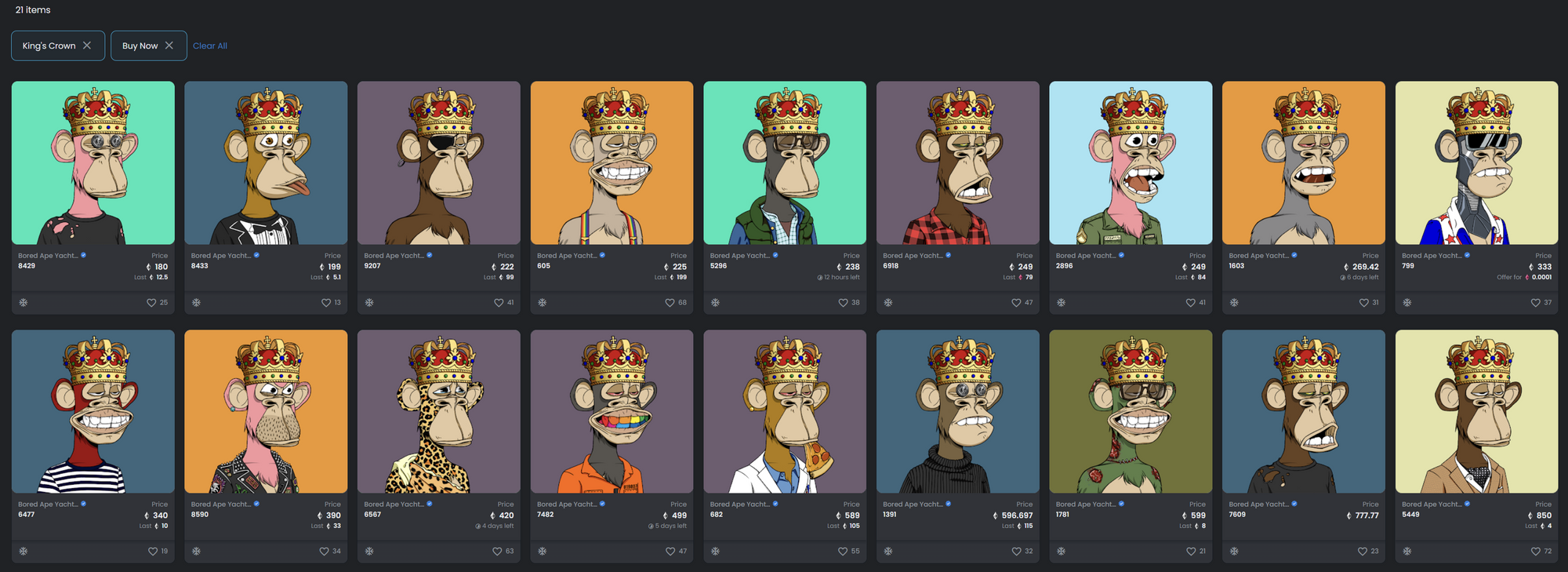

Today we will also look at a project that has quickly risen to become one of the world’s most renown and recognizable NFT collection.

Bored Ape Yacht Club (BAYC)

OpenSea collection

BAYC has quickly risen to be the top animal profile picture collection with celebrities such as Eminem, Stephen Curry, Logan Paul, Jimmy Fallon, Shaquille O’Neal, Steve Aoki, Mark Cuban, Pranksy, and Gary Vaynerchuk all purchasing one.

BAYC has been a testament to show the world what scarcity and a strong community is capable of.

9 months ago, you were able to mint a BAYC for the price of 0.08 Ethereum, roughly $250 dollars. Today the minimum price for a BAYC is 78 Ethereum, roughly $250,000.

That is a 10000% return on investment if you held for the entire 9 months.

The real absurdity begins when you begin to analyse the price of BAYC’s with rare characteristics. For example, there are only 77/10000 BAYC’s with the trait of a King’s Crown. The lowest price that you can pick one up for is currently 180 Ethereum, $567,000 dollars.

Having said that, your return on investment could have been much larger.

Are there benefits of being a BAYC holder?

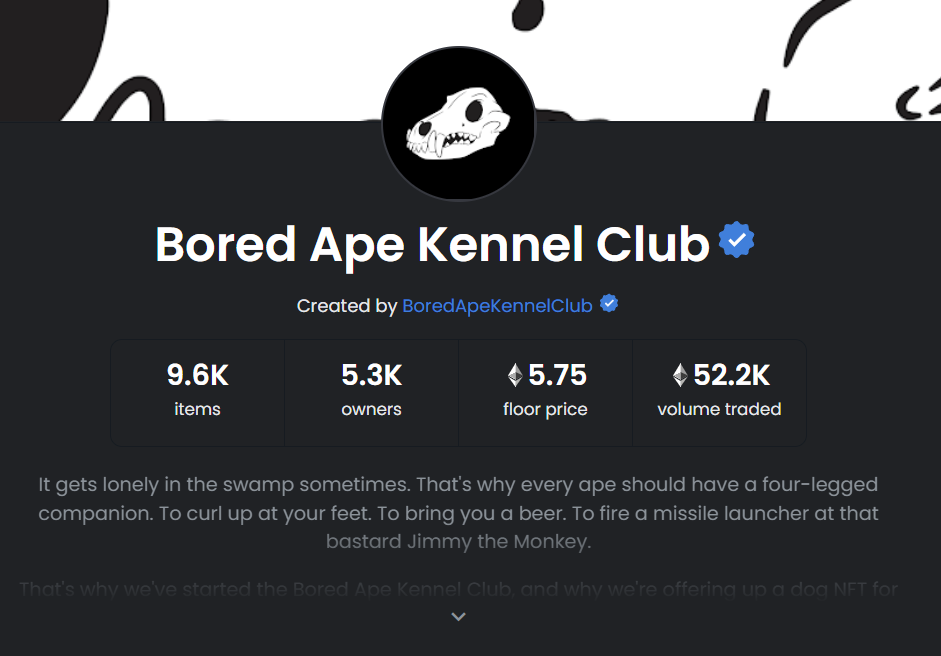

Apart from being a member of a very exclusive community BAYC has done a few things to reward their holders. First, it created the Bored Ape Kennel Club, offering owners the opportunity to "adopt" a dog NFT with traits that mimic those of the Bored Apes. Another freebie came in August: digital vials of mutant serum. Owners could mix their Bored Ape with the serum to create a Mutant Ape NFT. Both Kennel Club and Mutant Ape NFTs sell for a lot, making the ROI even higher.

The team is also not planning on stopping anytime soon. This is illustrated by their announcement of teaming up with Animoca, a Hong-Kong based software company, to create a play-to-earn game coming in 2022. However, it’s not been specified if BAYC holders will receive benefits.

A word from WizKid -

Thank you for reading our first Newsletter. We understand that the information provided may at first seem like a lot but we wish to ensure that the topics are covered in detail and that all readers are satisfied.

In addition, we are aware that the approach in this edition is quite broad in some topics but we aim to narrow down on topics more specifically once we get the ball rolling.

Thank you for reading and don't forget to subscribe to be notified for the next release.

- WizKid Team

Telegram daily market updates channel: https://t.me/WizKidSentiments

Telegram Ibiza Crypto Community group: https://t.me/IbizaCryptoCommunity

The information provided herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content recommended is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.