WIZKID NEWSLETTER (21 Jan - 4 Feb)

In here you will find all the necessary information to stay-up-to date with crypto's hottest trends, news and insights.

Everything you need to know compressed into a 5-10 minute read.

Newsletter topics:

- Crypto's hottest and most relevant news

- Technical analysis of the markets

- On-chain Analysis

- DeFi - What is TVL, new projects, and DeFi troubles

- NFTs - What are NFTs and how can they be incorporated into our world?

MAJOR CRYPTO NEWS

El Salvador purchases 410 more BTC amid market drop, president Bukele says, the nation now has over 1,500 bitcoins and plans to issue a $1 billion, 10-year bitcoin bond this year. This is a step forward towards the adoption of BTC by countries. January 22nd

Fantom becomes third-largest DeFi protocol by value locked, the value locked on DeFi-centric projects built on Fantom surged 52% in the past week. January 24th

January 26/27th FOMC meeting took place, a joint meeting of the Federal Open Market Committee and the Board of Governors of the Federal Reserve System. Very little new information was stated by speaker Jerome Powell. The FED still plans to proceed with interest rate hikes 3 to 4 times through 2022. Next meeting occurs in mid-March. January 26th

Fidelity files two more ETFs for the metaverse, i.e. more institutional investment into the sector. Asset management firm Fidelity has filed the ETFs with the SEC to track crypto firms active in the metaverse niche. January 28th

Russian government agrees on road map to regulate crypto. Government ministries and other official bodies agreed on principles for future crypto regulation. The Bank of Russia objects. January 28th

Global search interest for "NFTs" surpasses "crypto" for the first time in history. January 29th

Apple: the metaverse "is very interesting to us and we're investing accordingly", The metaverse has a lot of potential, according to Apple CEO Tim Cook. Apple sees the rapid expansion of the technology as “very interesting”. January 31st

Visa has announced that its customers made $2.5B worth of payments during the first quarter of 2022 using its crypto-linked cards. The company released these details during an earnings report. The company noted that this growth signalled that customers were deriving utility from these cards. The figure equated to around 70% of the total crypto volumes generated by the firm in the 2021 financial year. January 31st

Crypto exchange BitMEX airdrops 1.5M BMEX tokens to users, the tokens allow users to get trading discounts and other benefits on using BitMEX. January 31st

Jack Dorsey (Twitter founder) and Michael Saylor (MicroStrategy founder & largest BTC holder) will be the keynote speakers at the #Bitcoin for corporations conference held by MicroStrategy. More than 10,000 companies attended last year, including SpaceX and Tesla. February 1st

India attempts to properly regulate crypto with a 30% tax, Indian finance minister Nirmala Sitharaman presented the nation’s new digital asset tax proposal in parliament. February 1st

Germany's largest stock exchange saw a 922% increase in investor demand for cryptos products in 2021. February 1st

Japan’s $1 trillion crypto market may ease onerous listing rules, exchanges would be able to list over a dozen coins in one go and existing system make it hard for entrants to get market share. February 2nd

In addition; FTX buys crypto exchange Liquid Group for expansion in Japan, the deal announcement comes on the back FTX closing a $400 million funding round at a $32 billion valuation. February 2nd

Meta reports loss of $10.2B on augmented/virtual reality operations in 2021. The company formerly known as Facebook also reported 2021 revenue of $2.3 billion from the new division. February 3rd

Solana's SOL tumbles 10% after $326M wormhole exploit. An exploit on Wormhole, a bridge between the Solana and Ethereum blockchains, caused losses for SOL traders. FTX and Alameda are refunding the stolen funds. February 3rd

TECHNICAL ANALYSIS

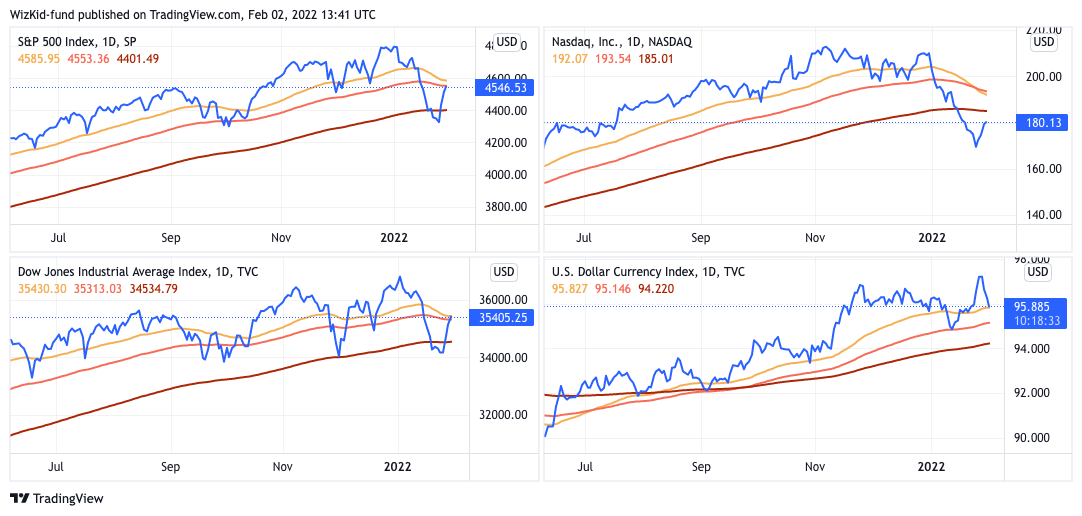

In this newsletter edition we will discuss the correlations between crypto and the traditional markets. First off it may help to assess the performance of the largest stock market indices; the S&P500, NASDAQ, DJIA, and the DXY.

S&P500 - tracks the performance of the 500 leading publicly traded companies in the US. The S&P is regarded as one of the best gauges of the stock market overall.

NASDAQ (composite) - is an index of over 3000 common stocks. Over 50% of which are tech stocks.

DJIA - Dow Jones Industrial Average - tracks the performance of 30 large US stocks (blue-chip stocks).

DXY - U.S. Dollar Index - is used to measure the value of the dollar against a basket of six world currencies—Euro, Swiss Franc, Japanese Yen, Canadian dollar, British pound, and Swedish Krona.

This 4 chart grid can show us the correlations between these indices, and their inverse correlation to the US Dollar over the last 9ish months. In Q4 2021 and in 2022 the dollar has risen whilst the stock market has chopped around and scared investors. This is largely due to the fears of interest rate hikes and monetary policy tightening by the US Federal Reserve. The response to this by investors has been; reduce risk. This means less exposure to stocks, especially in high growth sectors, which includes tech stocks and cryptos. The yellow, orange and burgundy lines are, respectively, the 50, 100 and 200 day EMAs. Moving averages show you the average price of an asset over a period of time. Being below the moving averages indicates downwards momentum and vice-versa. MAs often act as support or resistance for the price and can give a good indication of direction. As we can see on the chart, the Dollar DXY is trending upwards where-as the S&P, NASDAQ and DJIA are trending down. The S&P and the DJIA are testing their 50 & 100 day EMAs, and have recovered better than the NASDAQ, which is still below it’s 200 day EMA.

The performance of the stock market is very important in relation to trading BTC and Crypto. In the chart below we can see a comparison of BTC against the Russell 2000 Index (short name - RUT); which is a market index of 2,000 small-cap companies, which is frequently used as a benchmark for measuring the performance of small-cap mutual funds. Russell (RUT) is useful to consider when evaluating the risk attitude of investors in a macro perspective as it is an index composed of higher risk investments than the S&P or DJIA.

BTC & RUT (Russell 2000)

The correlation between RUT and BTC price action is apparent when highlighting the highs and lows of both assets in the chart above.

DXY BTC

As shown above, like the assets depicted in the first image, BTC is also inversely correlated to the US Dollar. The upper chart is the DXY which is in an uptrend and below is BTC which is in a downtrend since November. Shown with simple support and resistance lines (green and red line, respectively).

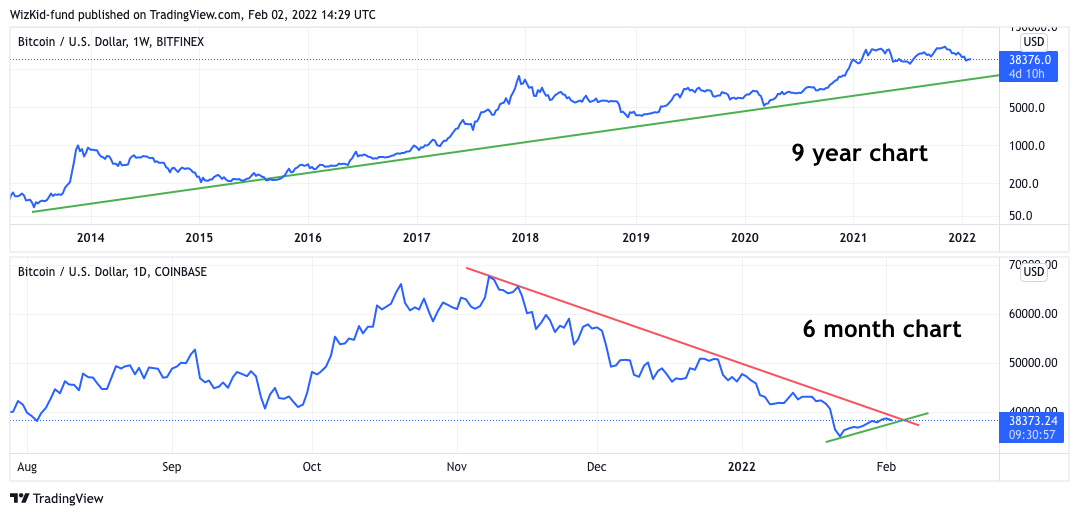

BTC - Zoom Out

The BTC price is in a clear downtrend in the mid-term, within a larger uptrend. On the chart below we can see the importance of your time-frame perspective. Your investment horizon is crucial in your investment decisions, the 6 month BTC chart paints a very different picture to the 9 year chart. As a short term trade or investment BTC is showing a lot of weakness, but for a long term investment it is still in a strong macro uptrend.

ON-CHAIN ANALYSIS

On-chain tools can provide insight into both supply and demand, and with an increasing bearish sentiment, we now try to find out whether the underlying demand is sufficient to start establishing whether the market has bottomed or is nearing a bottom.

It is important to note that on-chain metrics can be, and have been, manipulated by whales. Nevertheless, here at Wizkid Fund we pick out the statistics that are less likely to be affected by these big players and give a broader understanding of where the market could be heading.

The Bitcoin market has continued to slide lower, reaching $33,424 on Monday, the lowest traded price since July 2021. Prices have now been in an established downtrend for 85-days, and negative sentiment has spiked higher as can be seen on the fear and greed index hitting extreme lows.

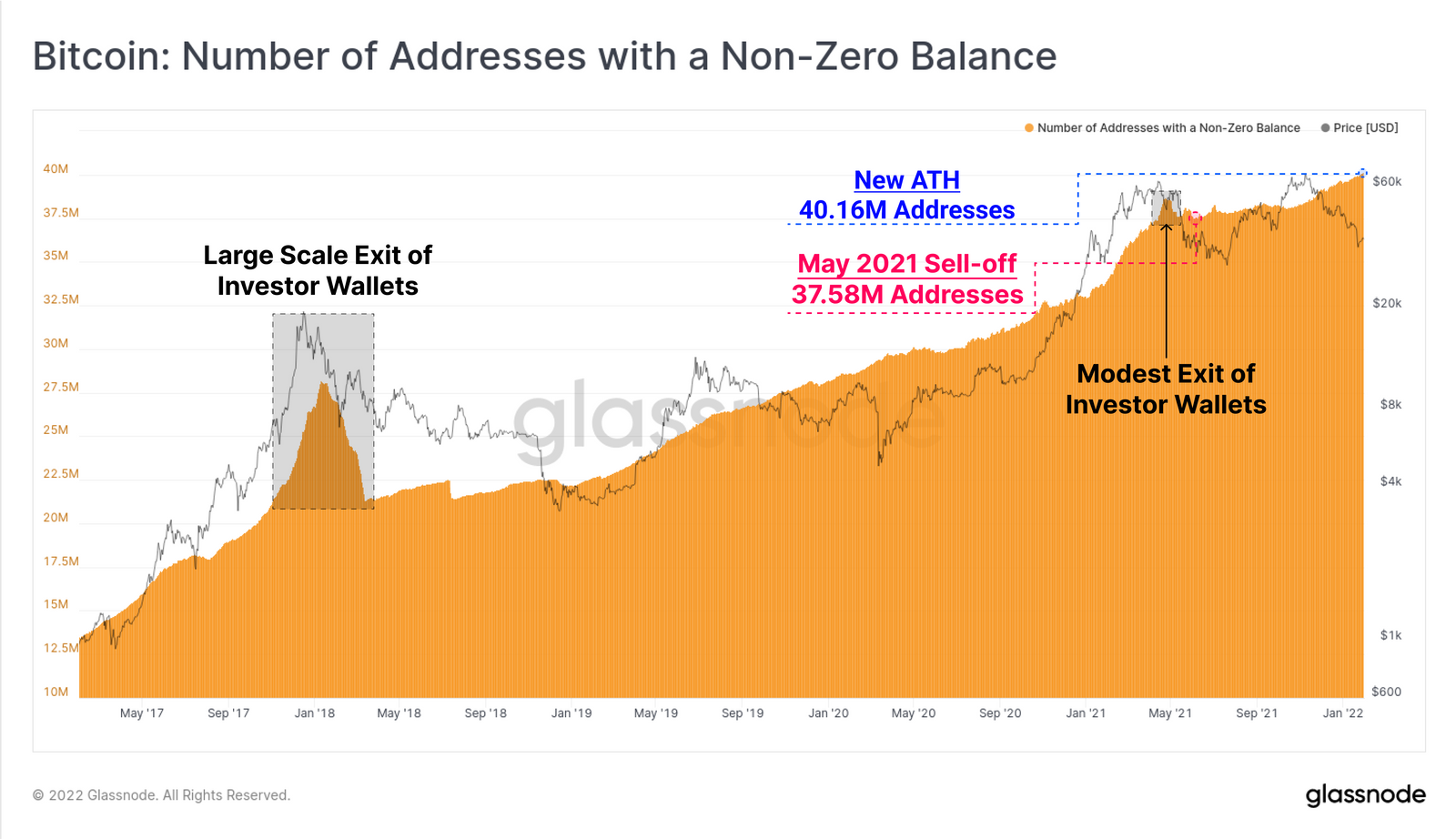

Metric 1

Bitcoin: Number of Addresses with a Non-Zero Balance

The first fairly foundational and simple metric that we will be analysing today is called the “Bitcoin: Number of Addresses with a Non-Zero Balance”.

In simple words, a chart illustrating the number of wallets holding Bitcoin in relation to the USD price of BTC.

Generally speaking, when the Bitcoin network experiences a large-scale investor flush out (such as the 2017 blow-off top), investors send their BTC to exchanges and slowly start selling off; resulting in a drop of addresses holding BTC.

However, the current upward trajectory of non-zero wallets appears to be largely unaffected by the last three months of depressing prices whilst also hitting a new all-time high (ATH) of 40.16 Million addresses.

The way we see it this is a perfect illustration of more trust and conviction entering the market and a growing class of 'sat stackers' and HODLers who remain throughout all market conditions.

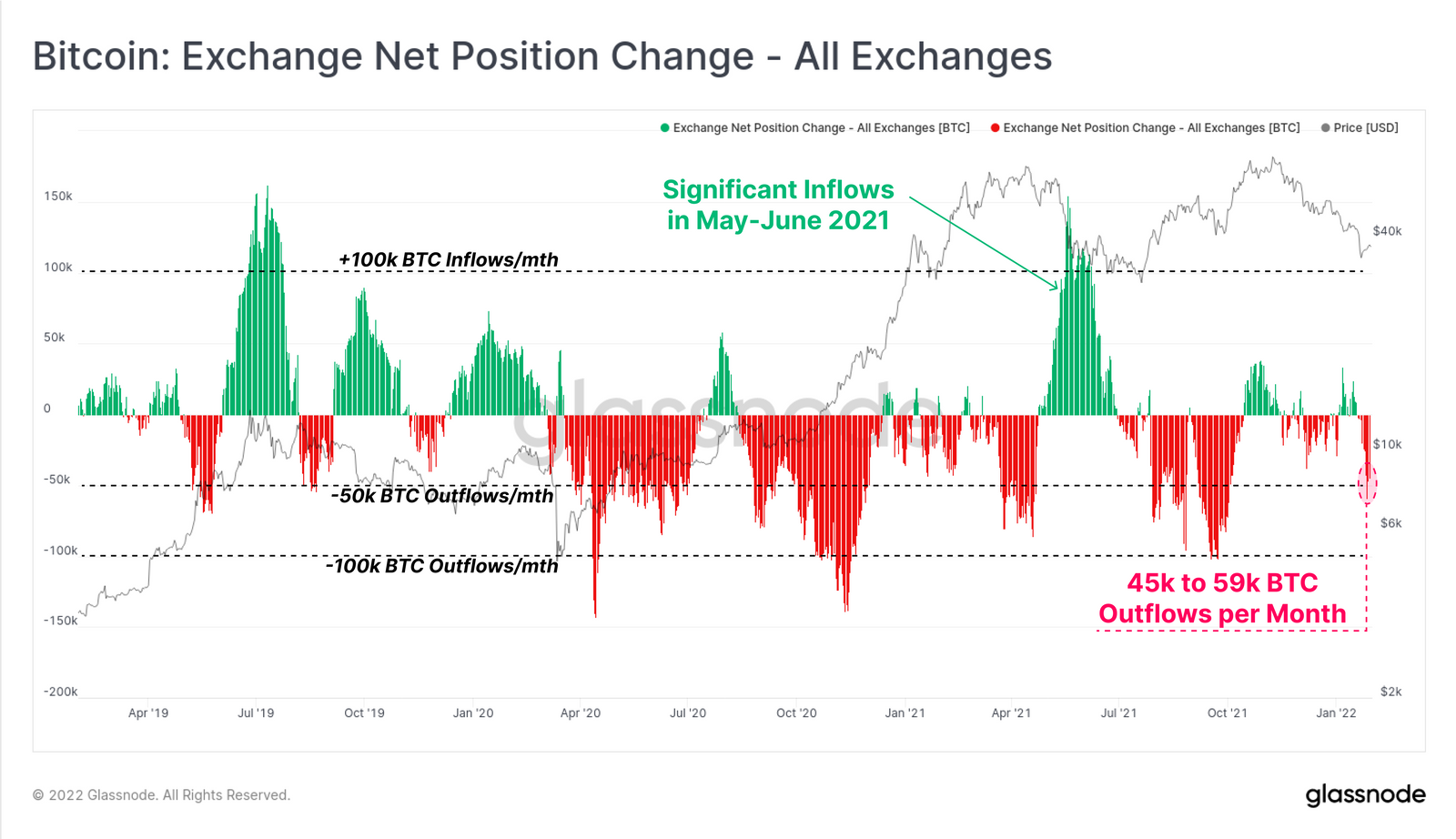

Metric 2

Bitcoin: Exchange Net Position Change - All Exchanges

The second metric that we will analyse today is “Bitcoin: Exchange Net Position Change – All Exchanges”.

In simple words, A chart representing the net monthly flow of coins in (green), and out (red) of the exchanges we track.

This week, we have seen net outflows of a reasonably high magnitude, with rates between 45k and 59k BTC per month, indicating that some portion of the withdrawn coins may have moved to cold storage.

Following this, the Bitcoin exchange reserves have declined to multi-year lows, reaching roughly 13% of the circulating supply. It is important to point out that this is very different to how the market reacted in the May-July 2021 drawdown.

Both corrections have seen a 50%+ drawdown from Bitcoin all-time high. During May-July 2021 we saw over 164k BTC flowing into exchanges whereas the current drawdown has seen exchange balances decline by 42.9k BTC since November.

Despite equivalent scale drawdowns, the trends in exchange reserves are trending in opposite directions. The current environment has a noticeably more bullish undertone, and far fewer coins being spent and sold in fear.

From my understanding, these 2 metrics are pointing towards a reversal in sentiment and price for Bitcoin in the short-term.

Time to load them bags!

NOT FINANCIAL ADVICE

DEFI UPDATE

DeFi - Decentralised finance (DeFi) is an emerging financial technology which removes the control banks and institutions have on money, financial products, and financial services.

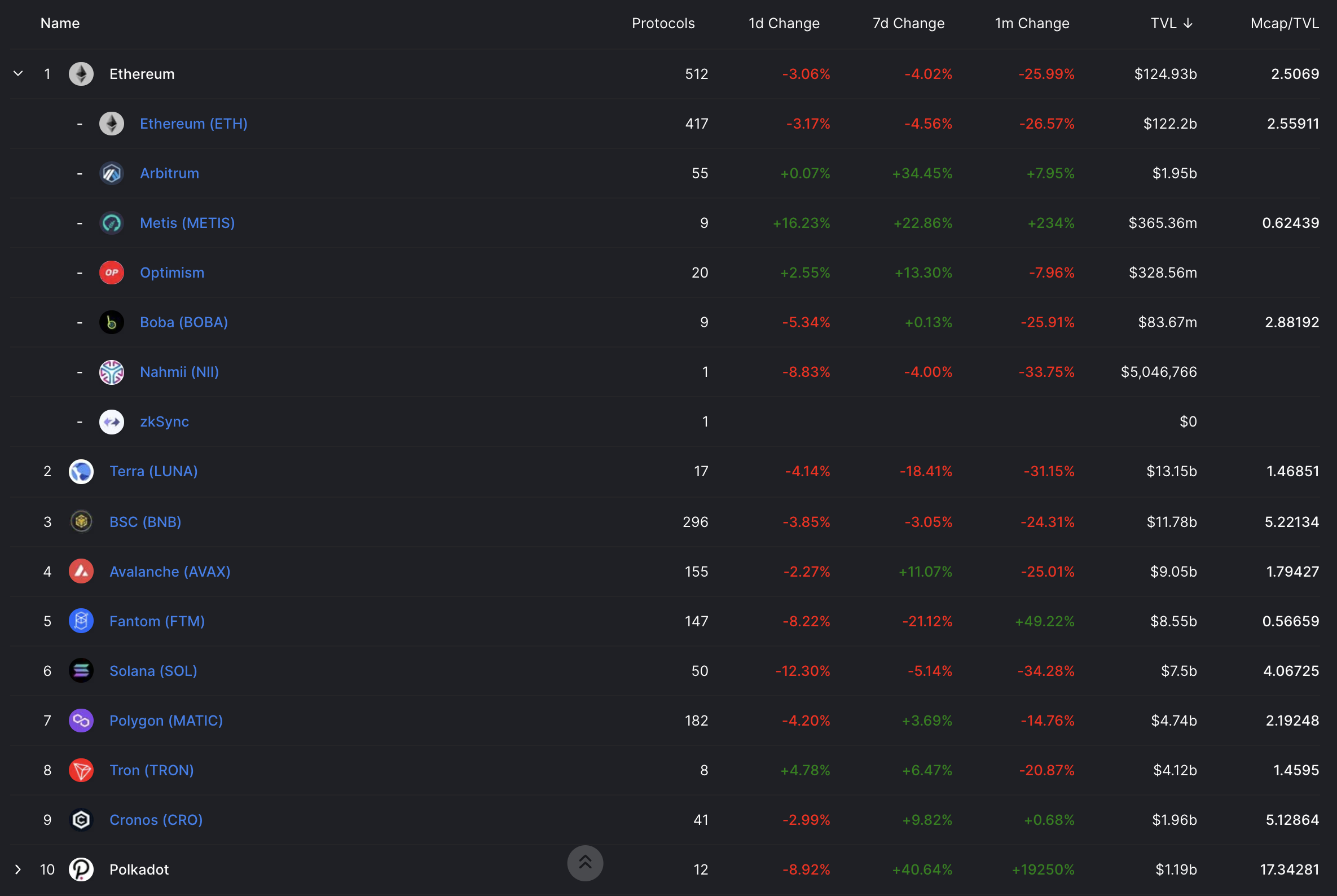

Let's look at the TVL (total value locked) over the different blockchains to understand where the money is flowing at present;

As we can see above, the total value locked is decreasing across nearly all chains of late, other than Fantom, Cronos, and Polkadot. Within the Ethereum network the side-chain / roll-up solutions; Arbitrum, Metis and Optimism are increasing in TVL rapidly. This will stimulate the price of projects on these chains and is a good sign of adoption/growth. The boom in DOT's TVL is unexpected and significant, something to watch.

I will be looking further into Arbitrum and Optimism projects over the coming weeks and will discuss some projects in next newsletter's DEFI section. One to watch currently is JonesDAO, which had a very strong launch. JDAO is a yield, strategy, and liquidity protocol for options, with vaults that enable 1-click access to institutional-grade options strategies while unlocking liquidity and capital efficiency for DeFi options with yield-bearing options-backed asset tokens. Read their docs here. Pre-sale investors are up 2x in a week. Chart.

Another new Arbitrum project: Vesta Finance, $VSTA, has just done a final public token sale on CopperLaunch, which I participated in. Vesta intend to be the leading decentralised and over-collateralised stablecoin protocol on Arbitrum. The token $VSTA would be comparable to LUNA in relation to their stablecoin UST. Read a simplified explanation of the project here. They have a partnership with OlympusDAO who are helping them with liquidity and marketing. Chart.

Here I am retracting one of my picks from our previous newsletter; Wonderland/$TIME. Shocking discoveries have rattled the project as their previously anonymous CFO (Chief Financial Officer), @OxSifu who was in charge of Wonderland's $1billion treasury, has been unmasked as serial scammer and fraudster, Michael Patryn. Sifu will be removed as Wonderlands treasurer, but the project has suffered a huge sentiment change and prices have tumbled. Chart. This event will likely cast a dark shadow over DeFi in the months to come, especially in the eyes of regulators. The community behind founder Daniele is very strong so a recovery for the project is possible, but with the conspiracies and uncertainty circulating at present the price may well never recover. Here is one of the pitfalls of projects with anonymous team members; remember,

This has also cast a terrible light on Daniele, who is involved in multiple other high-tier DeFi projects, such as Abracadabra, MIM & Popsicle Finance. These projects all still have great value propositions and are not directly related to Sifu, therefore in the aftermath of this scandal, some good deals may be scooped up.

NFTs

What are NFTs?

In the simplest terms, NFTs transform digital works of art and other collectibles into one-of-a-kind, verifiable assets that are easy to trade on the blockchain.

Non-Fungible Tokens (NFTs) are one of the most powerful concepts to emerge from blockchain technology. This is especially noticeable when you analyse the NFT marketplace user statistics like we did in last weeks Newsletter. NFTs are changing the world through their ability to digitize literally anything and everything. Not only do NFTs digitalize assets, they create a platform where we are able to transact in a trustworthy and transparent manner, with anyone, anywhere, and at any time of the day, while also being able to prove ownership via the blockchain.

Let's look at all the various ways in which NFTs could be incorporated into our world.

How can NFTs be incorporated into our world?

1. Digitalization

There is no doubt that we are living in a more digital world than ever before. Until now, this has primarily been experienced through social media and online-shopping becoming the preferred way to communicate, and purchase goods and services.

The thing is, NFTs completely change the game as any physical asset can become a verifiable digital asset. The ability to digitize anything, be it a house, a vehicle or even a concert ticket, is something we’ve never been able to do.

So, let's say that beautiful house you just bought in Ibiza also came in the form of an NFT. This NFT also includes the contract for the loan on your house, and even allows you to make payments from your crypto wallet, all while being displayed in your wallet as proof that you own that loan for that specific house. In addition, you would instantly be able to verify any previous owners and transactions done for the property and/or estate. Proof of ownership has never been more independently traceable.

Every phone, car, purse, shoe, and ring in the world could have verifiable ownership in the form of an NFT available to anyone within a split second.

2. Decentralization

One of my favourite traits about NFTs is their decentralized nature. NFTs live and breathe on the blockchain, the blockchain in this instance acts as a digital ledger that proves ownership, tracks every transaction and, most importantly, cuts out middlemen.

In a decentralized world, the quality of life could change drastically. It would give us the capability to earn more from our hard work and transact more efficiently than ever before. With transactions happening directly between two parties and no middleman to interfere, we would have a world of harmonious and transparent agreements.

Just imagine a world where there is no permission needed to transact anything, no matter the asset size.

3. Transparency

One of the attributes that has always stood out to me with blockchain technology is its transparency.

This kind of transparent relationship between people benefits everyone. When it comes to web 3.0, there is no more lying about what you own, who you are, or what your interests are, because everything you own is displayed digitally for the world to view.

Of course, your wealth could be distributed through several hot and cold wallets but, generally speaking, its more transparent than the current system.

4. Access

In the traditional world we are restricted to the set working days and hours within our country. Generally speaking, we can only do major transactions from Monday-Friday within an 8–10-hour time window.

This is where the Crypto world differs. Due to its decentralized nature, we can transact 24/7, 365 days a year. Considering that the blockchain is always in operation and people are transacting at different times of the day, all around the world, NFTs allow creators and consumers to interact directly with each other at all hours of the day, and night.

To my point, NFTs give creators the means to offer any product and/or service to anyone, anywhere, and at any time, benefiting both parties by simplifying the transaction and forming a more personalized experience overall.

5. Social Signalling

From a psychological standpoint, humans love to communicate and share our interests and passions to others. This has become the primary use case of social media. Whether that person portrays themselves authentically or not has always been up for debate, until now.

Non-fungible tokens are the new form of social signalling. Except with NFTs, you better be ready to handle the truth, because that's all you are going to get.

For example, Twitter has introduced a new feature (Twitter Blue) to their platform where users can verify the ownership of their NFT by connecting their own cryptocurrency wallet to their Twitter accounts. The verified NFT profile photo is shown with a fancy new hexagonal shape rather than the circular standard shape. As seen in the image below.

This type of social signalling is not a new behaviour at all, but NFTs give it a new truth. The fakers will not benefit from this new truth, but rather they will be exposed. Likewise, the authentic ones will greatly benefit from remaining honest and proving their authenticity through the adoption of NFTs.

6. Royalties

Historically speaking, influential artists such as Vincent Van Gogh wouldn’t make much money in their time, whereas today their pieces are selling for hundreds of millions of dollars. Personally, this doesn’t sit right with me that artists can pour their blood, sweat, and tears into their work early on in life, only for his family not benefit from their labour as time goes on, assuming that they already distributed their work and no longer have possession.

Non-fungible tokens are in the process of changing this by granting creators a new perk: the ability to receive royalties from secondary sales on any of their original work. If the creator sets a royalty percentage however, not only will they be able to earn money from their original work, but the collector is still able to sell the piece for a profit, as well. A true win-win scenario, wouldn't you say so?

In addition, there is a new movement in place called “social impact” NFT collections. This is where a certain percentage of the royalties are gifted to charities or projects that are chosen by the founders or community.

With all this being said, NFTs have a bright future ahead of them. We are still in the early stages of identifying where they can truly be adopted into our real world. For now, they are primarily focused on collectibles such as art and as a form of social signalling. Who knows where we will be in 5 years from now but it would not surprise me if the cars we own now would have a digital copy available on the blockchain.

I also believe grasping a deep understanding of NFTs and positioning oneself where they can help others to adopt and implement them into their business will be a profitable strategy in the years to come.

A word from WizKid -

Thank you for reading and don't forget to subscribe to be notified for the next release. This can be done by entering your email in the home page and then confirming it in your email.

- WizKid Team

Telegram daily market updates channel: https://t.me/WizKidSentiments

Telegram Ibiza Crypto Community group: https://t.me/IbizaCryptoCommunity

The information provided herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content recommended is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.